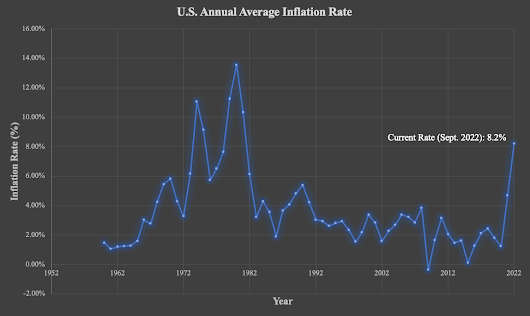

2022 has been a difficult year for many Americans. The United States, like much of the world, continues to face the COVID-19 pandemic and the many issues it has spurred. In May 2022, the Pew Research Center reported that, according to recent research, U.S. citizens reported that inflation was the most important issue facing the country. Inflation, by definition, measures “the overall impact of price changes for a diversified set of products and services.” As inflation rises, purchasing power declines. In more practical terms, an increase in inflation means you can buy less with the same amount of money than you could previously. That effect is likely why so many Americans list inflation among their top concerns today.

Making the aforementioned results

even more concerning is the fact that they were released before inflation even

peaked in the U.S. This past June, the

inflation rate reached as high as 9.1%.

As the fall season approaches, it is still hovering north of 8%.

What

effect the IRA has on national inflation remains to be seen. Many experts project that the IRA will not dramatically

reduce inflation in the near future. Even

so, the legislation will implement various tax changes in the short-term that

will impact individuals as well as businesses and other organizations. Here are some of the most notable changes and

how they might affect you as a business owner.

This has been among the

most-discussed aspects of the IRA, but fortunately for most business owners,

this will not affect them. The new

minimum tax of 15% will only apply to corporations with a

book income threshold of one-billion dollars. S

corporations, regulated investment companies, and real estate investment trusts

are not included.

Overall, this provision will likely apply to only about 150 corporations.

Thus, despite the publicity of this particular change, the vast majority

of business owners can disregard it.

Another prominent facet of the IRA is increased support

for the IRS. The IRA specifically designated

approximately $80 billion in new funding for the IRS. Over half of this total, about $46 billion,

has been directed to be used for enforcement.

Naturally, this may incite anxiety about potential increases in audits

for business owners. However, it appears

that these funds will not be utilized to target most small businesses.

The Research and Development Tax Credit was established in 1981 as a way to incentivize U.S. business growth. Starting in 2023, the credit will double from $250,000 to $500,000. It can be used to offset expenses meant for organization improvements, as well as payroll taxes. Typically, “qualifying expenditures… include the design, development or improvement of products, processes, techniques, formulas or software.” Some type of “hard science” must usually be involved as well. Examples of eligible activities may include costs for patent development, wages for employees conducting qualifying research, and supplies used for qualifying research and development. Section 41 of the Internal Revenue Code covers qualifying expenses in more detail.

Excise Tax on Corporate Stock Repurchases

This provision, much like the aforementioned new

corporate minimum tax, has gained much attention but likely will not affect

most small businesses. Per the IRA,

corporate stock repurchases may be subject to a 1% excise tax.

However, there are multiple exceptions, including situations where the

total repurchased stock is valued at less than $1 million for the year.

Approximately

25% of the Affordable

Care Act (ACA) Marketplace is composed of small-business owners and

self-employed individuals. This

constitutes over 2 million individuals. The

IRA will ensure that ACA subsidies, which were increased in response to the

COVID-19 pandemic, are extended through 2025. In other words, the many Americans who

utilize these subsidies, which were supposed to expire at the end of this year,

can continue to benefit from them.

Among the aims of the IRA is to

battle climate change through clean energy incentives. One of the provisions designed to support

this goal involves tax credits for electric vehicles. The IRA allows for credits of up to $7,500 for commercial

vehicles weighing less than 14,000 pounds and up to $40,000 for commercial

vehicles over 14,000 pounds. Simply

put, business owners can reduce their tax load by purchasing electric

vehicles. Unfortunately, this provision

will not commence until 2024.

Another set of provisions intended

to support sustainability is the expansion of energy investment tax credits

(ITC). This will allow for more projects

that previously qualified only partial ITC claims to receive full ITC claims.

A common example for businesses is a solar photovoltaic system, which provides solar power. For more detail on these provisions, look here.

Section 179D of the Internal Revenue Code (IRC) has

allowed building owners to receive tax deductions if they implement

architectural systems that meet certain requirements.

One of the primary requirements will be that the system installed boosts

energy efficiency by at least 25%.

For more information, you can look here.